How To Add Stop Loss In Thinkorswim

Advanced Stock Order Types to Fine-Melody Your Marketplace Trades

Basic stock club types tin nonetheless cover most of your trade execution needs. Perchance it's time to move beyond the basics. Learn about OCOs, subclass orders, terminate-limit orders, and trailing stop orders.

Photo by TD Ameritrade

Cardinal Takeaways

- Advanced stock orders are designed for special trading circumstances that require actress specifications

-

Virtually advanced orders are either time-based (durational orders) or condition-based (conditional orders)

- Advanced order types can be useful tools for fine-tuning your society entries and exits

If you're an experienced trader, one whose strategies accept grown toward the more sophisticated side of things, then your merchandise entries and exits might require a bit of extra nuance. In many cases, basic stock club types tin still cover nearly of your trade execution needs. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. As with the more than basic variety of stock orders, you probably want to know these advanced order types really well and then you tin can match them to the appropriate context and avoid errors that could be risky or costly. Annotation that some order types described hither straddle the "basic" to "advanced" category—then y'all might want to familiarize yourself with all of them to better understand when and when non to use them. Before we get started, there are a couple of things to note. These advanced order types fall into ii categories: conditional orders and durational orders. Conditional means that an social club is to exist filled under specific weather condition or that the fill will trigger a condition. Durational means that an society must take identify within a specific time frame, or "time in strength". A one-cancels-other (OCO) order is a provisional club in which two orders are placed, and one social club is canceled when the other society is filled. This may sound complicated, but it'south fairly easy to sympathize in context. Available in most trading platforms designed for active traders, a bracket order will immediately place an OCO "accept turn a profit" and a cease society once a position is opened. A finish-limit order allows yous to define a price range for execution, specifying the price at which an gild is to be triggered and the limit price at which the order should be executed. Information technology substantially says: "I want to purchase (sell) at cost 10 but not any higher (lower) than toll Y." Suppose you're eyeing a stock that's trading at $120. You want to buy when the cost reaches $125, but not if information technology exceeds $130. Then yous identify a terminate-limit lodge—a buy stop at $125 and a buy limit at $130. By doing this, your society tin get triggered at the lower (specified) toll while preventing any orders from being triggered beyond your price limit. Then if the stock opens at a gap beyond $130, your order isn't filled until the price falls back to $130 or below. For brusk sale positions, you'd do the reverse. If yous're using the thinkorswim® platform, you tin gear up brackets with stop and terminate-limit orders when placing your initial trade. Under the Trade tab, select a stock, and choose Purchase custom (or Sell custom) from the menu (run across figure i).One-Cancels-Other Club

Subclass Order

Finish Limit Order

Figure 1: BRACKET ORDERS. To bracket an guild with profit and loss targets, pull up a Custom gild. Epitome source: the thinkorswim® platform. For illustrative purposes just.

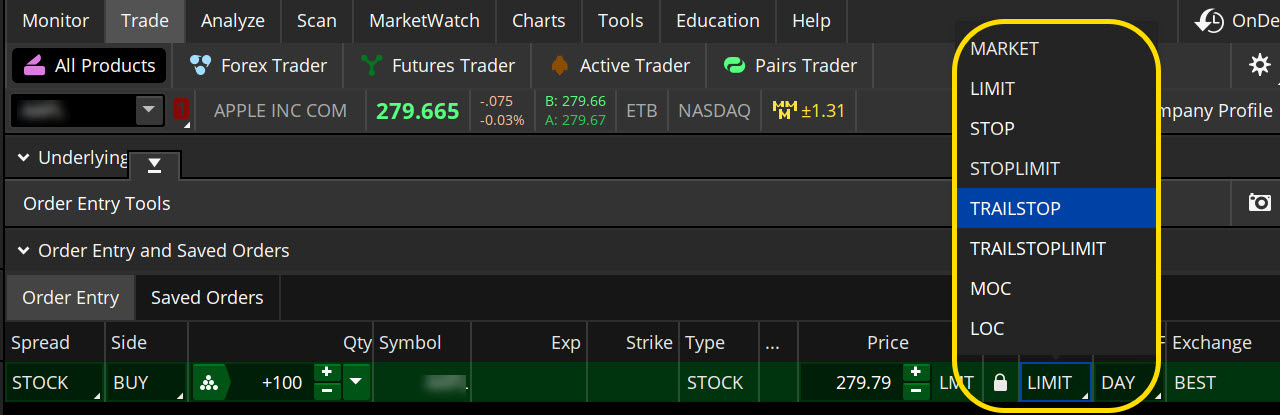

This durational guild tin can exist used to specify the time in force for other provisional club types. It basically means: "Continue this social club active until I abolish it." Orders that haven't been filled past the cease of the twenty-four hour period are ordinarily canceled in one case the market closes. Simply if yous want to keep a buy order or sell guild in identify until information technology's filled, or however long your broker will allow you to keep it agile (typically no more than 90 days), this is when yous might want to use a GTC lodge. A chip of common sense: If you're placing a conditional order type that involves ii or more orders, brand sure that the time in force (TIF) for each order is identical. For example, if you're placing an OCO (1-cancels-other) guild, it wouldn't be good if the order to be canceled immediately is a GTC (good 'til canceled) lodge. Likewise, don't misfile a day gild (which gets canceled at the end of the day) with a GTC order (which doesn't get canceled at the cease of the twenty-four hour period). You don't want to be surprised by a "mystery position" the following day floating effectually in the negative return zone. In the thinkorswim platform, the TIF carte is located to the right of the order type. Abaft stops are non "orders" per se, but they're a means to automatically move or "trail" stops (basic stop orders). Think of the trailing finish every bit a kind of get out program. Here's how information technology works. Allow'southward say y'all purchased shares of stock, and your entire position is now in the profit zone. What might y'all do with your terminate? You can leave it in place. You can move it up to a more "break-fifty-fifty" level to avoid loss should the marketplace move against you lot. Or you can set it to "trail" your profitable position every bit it moves higher. You're probably thinking, "OK, but how far below my position should the trailing stop follow?" In that location are many ways to summate a trailing finish. If you're using the thinkorswim platform, you lot could pull up an order ticket and select from the menu nether the order blazon (see figure ii). The choices include basic society types as well equally abaft stops and cease-limit orders.Good 'Til Canceled (GTC) vs. Day Order

A Quick Annotation on Time in Force

Abaft Cease Lodge

Figure 2: Club TYPES. To select an order type, choose from the menu located to the right of the toll. Image source: the thinkorswim® platform. For illustrative purposes merely.

Earlier implementing whatever of these order types, it's important to know a few more than things about end orders. With a stop limit order, you gamble missing the market altogether. In a fast-moving market place, it might be impossible to trigger the order at the finish toll, and so to execute it at the terminate-limit cost or amend, and then you might not have the protection you sought. A trailing stop will non guarantee an execution at or almost the activation price. One time activated, they compete with other incoming market orders. And, of grade, a limit club doesn't guarantee execution as the market may never reach your limit cost. Avant-garde order types can be useful tools for fine-tuning your order entries and exits. But you lot need to know what each is designed to accomplish. And as with any merchandise idea or component you're trying out for the first time, consider practicing get-go in a simulated environment such as the paperMoney® stock market simulator on the thinkorswim platform.The Bottom Line

Archaic Corner:

A Few Order Types Rarely Used by Retail Investors

Immediate-or-Cancel (IOC) Order

This durational order is like to the all-or-none guild, merely instead of dealing in quantities, information technology deals with fourth dimension. Essentially, the IOC club says: "Give me as much of my social club as possible within this specific time frame (normally a few seconds) and cancel all unfilled orders in one case that fourth dimension has passed." You lot can specify the time in forcefulness for this type of order.

Suppose you want to buy 5,000 shares of stock, but y'all don't want to get filled at a broad range of prices. Or maybe volume is on the thin side and y'all don't want to movement the market place. You can place an IOC market or limit club for five seconds before the order window is closed. Yous might receive a fractional fill, say, 1,000 shares instead of five,000. But you tin e'er repeat the order when prices once over again achieve a favorable level.

Why this is rarely used: Dissimilar institutional investors who can trade at high levels of volume, well-nigh investors don't have to worry about moving the markets. Arguably, a retail investor tin move a highly illiquid market, such as those for penny stocks. But generally, the boilerplate investor avoids trading such risky assets (and brokers discourage it). Hence, there's not much need (or demand) for this type of order.

All-or-None (AON) Order

Its name says it all: "Give me the entire quantity of shares I'm request for or don't give me whatever at all." An AON society ensures that you won't get a partial fill. Then if y'all order 1,500 shares of a stock, you'll receive exactly that amount, as long as at that place are enough shares at the time of the club to fill up your request.

Why this social club type is practically nonexistent: AON orders were commonly used amidst those who traded penny stocks. Over again, near investors avert penny stocks because of their high hazard profile, and about brokers adopt it that fashion, if but to reduce client and broker risk. Hence, AON orders are generally absent from the society carte du jour.

Fill-or-Kill (FOK) Order

The FOK order is unique in that information technology's the merely gild blazon you don't want to yell over the phone to your broker when in a public setting, equally people invariably become the wrong thought. Aside from this, the FOK order is like an all-or-nothing (AON) club only with the time limit of an immediate-or-cancel (IOC) guild.

Confusing? It'south not, really. The FOK order substantially ways: "Fill my unabridged guild within the specified time frame or kill the order." For example, suppose you lot desire to purchase exactly 500 shares of stock within the next x seconds. If the shares are available within that x-second time frame, you lot'll get filled. If non, your order volition expire later x seconds.

Why this club type is practically nonexistent: FOK orders, although nuanced with a bent toward accurateness, accept enough conditionals to make them impractical. In other words, many traders end upward without a fill up, and then they switch to other order types to execute their trades. Over time, traders have mostly used other order types, finer "killing" the fill up-or-kill gild through low demand.

Desire to larn more near basic stock order types? Lookout man this brusk video:

Basic Stock Gild Types: Tools to Enter & Exit the Marketplace

five:39

Key Takeaways

- Advanced stock orders are designed for special trading circumstances that require extra specifications

-

Nearly advanced orders are either fourth dimension-based (durational orders) or condition-based (provisional orders)

- Advanced social club types tin can be useful tools for fine-tuning your social club entries and exits

Outset your e-mail subscription

Recommended for yous

Related Videos

How To Add Stop Loss In Thinkorswim,

Source: https://tickertape.tdameritrade.com/trading/trading-basics-advanced-stock-order-types-17852

Posted by: massasady1977.blogspot.com

0 Response to "How To Add Stop Loss In Thinkorswim"

Post a Comment